mississippi income tax rate 2020

079 average effective rate. 3 on the next 1000 of taxable income.

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

The graduated income tax rate is.

. Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 S Corporation Income Tax Laws. STATucator - Filing Status. The 2020 COVID-19 Mississippi Business Assistance Act.

EITCucator - Earned Income Tax Credit. This means that these brackets applied to all income earned in 2019 and the. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001.

Senate Bill 2858 2016 Legislative Session - Miss. 3 on the next 2000 of. Before the official 2022 mississippi income tax rates are released provisional.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Mississippi State Tax Quick Facts. HOHucator - Tax Tool.

Mississippis income tax currently has three marginal rates of 3 percent 4 percent and 5 percent. 80-100 Individual Income Tax Instructions. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

For the Single Married Filing Jointly Married Filing Separately. How do I compute the income tax due. Mississippi has a graduated tax rate.

71-661 Installment Agreement. Tax rate of 5 on taxable income over 10000. 18 cents per gallon of regular gasoline and.

Corporate Income Tax Returns 2020. PENALTYucator - Late Filing Payment Penalties. All other income tax returns P.

Owner-occupied housing unit rate 2016-2020. 4 on the next. 0 on the first 3000 of taxable income.

Detailed Mississippi state income tax rates and brackets are available on. 27-7-5 and 27-7-18 Beginning with tax year 2018 the 3 income. Title 27 Chapter 8 Mississippi Code.

There is no tax schedule for Mississippi income taxes. Any income over 10000 would be taxes at the. Mississippi Tax Brackets for Tax Year 2021 As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

Taxable and Deductible Items. Before the official 2022 mississippi income tax rates are released provisional. There is no tax schedule for Mississippi income taxes.

Detailed Mississippi state income tax rates and brackets are available on. Median selected monthly owner costs -with a. Tax Rates Exemptions Deductions.

Mississippis income tax currently has three marginal rates of 3 percent 4 percent and 5 percent. IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80-107. Mississippi has a graduated income tax rate and is computed as follows.

Mississippi also has a 400 to 500 percent corporate income tax rate. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. Tax rate of 4 on taxable income between 5001 and 10000.

The graduated income tax rate is. These rates are the same for individuals and businesses. Median value of owner-occupied housing units 2016-2020.

0 on the first 4000 of taxable income.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Will Mississippi Join The No Income Tax Club

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

How Long Has It Been Since Your State Raised Its Gas Tax Itep

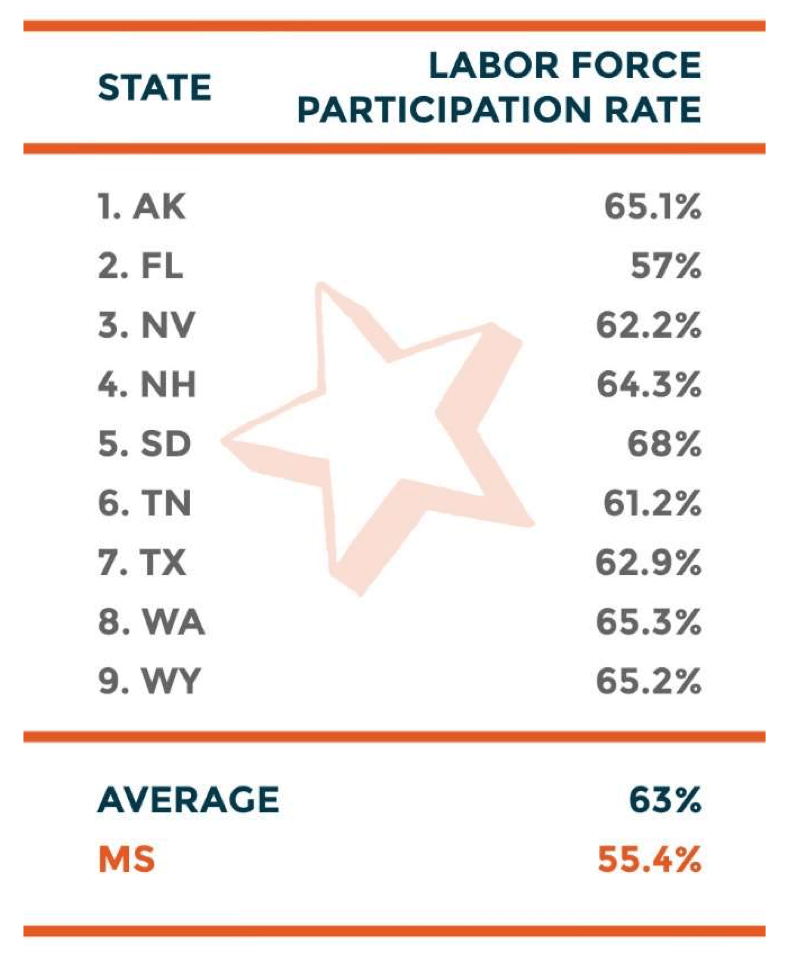

Income Tax Free States Greatly Outpace Mississippi Across Several Key Indicators

Mississippi State Tax H R Block

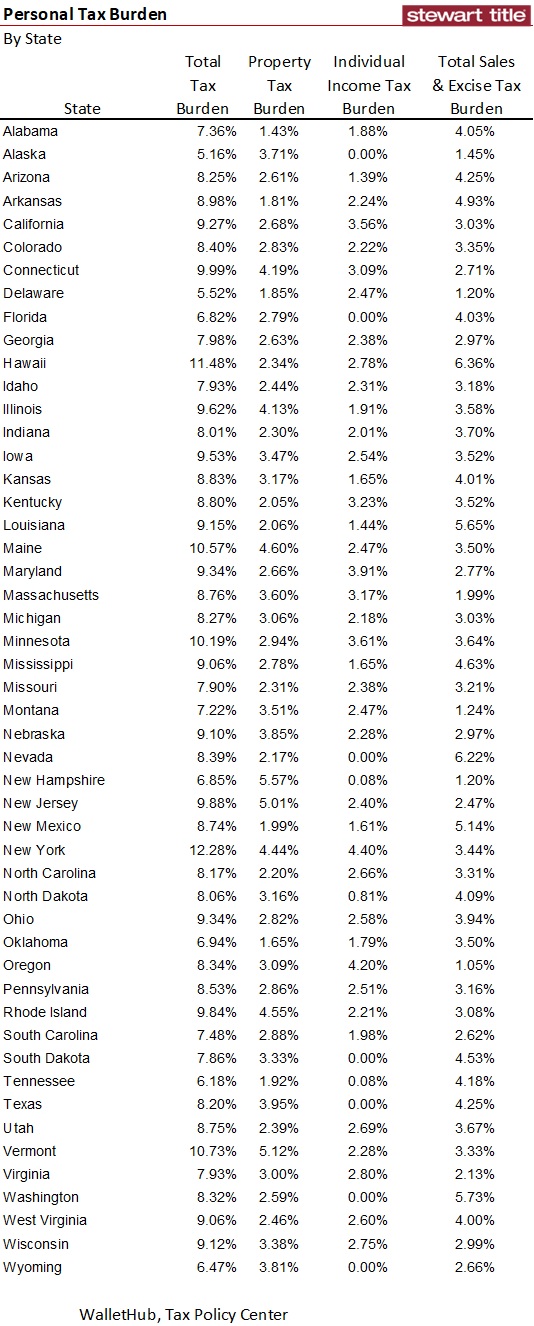

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

U S Sales Taxes By State 2020 U S Tax Vatglobal

Study House Tax Proposal Increases Burden On Poor Mississippians Mississippi Today

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

Mississippi Could Soon Tax Third Party Internet Sales The Northside Sun

Tax Withholding For Pensions And Social Security Sensible Money

Mississippi Income Tax Reform Details Evaluation Tax Foundation

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Mississippi Who Pays 6th Edition Itep

Mississippi State Income Tax Ms Tax Calculator Community Tax